- November 21, 2023

- Posted by: admin_IT

- Category: Analysis Paper

|

Listen to the Article

Getting your Trinity Audio player ready...

|

The Monetary Policy Committee (MPC) is committed to seeing efficient, stable and competitive financial markets with minimal obstacles and regulations for sustainable economic development. The Committee meets regularly and ensures that monetary policy complement fiscal discipline towards achieving low inflation and financial stability. Recently, the Committee met on 23 October 2023 and made resolutions on policy measures to that effect, which are also critical towards enhancing .

The Commission therefore analyses the resolutions on the following monetary policy tools to ascertain their impact on business competitiveness: –

Interest Rates

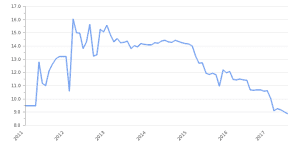

The MPC reduced, with immediate effect, the Bank Policy rate from 150% to 130% per annum, and the Medium-term Bank Accommodation (MBA) interest rate for the productive sectors including individuals and Micro, Small and Medium Enterprises (MSMEs) was maintained at 75% per annum.

This implies that banks can now access finance from the central bank more cheaply, hence improving their financial soundness. More is now available for lending to the productive sectors and individuals. Commercial bank loans and advances responded positively, increasing from ZWL1.7 to ZWL8.5 billion in March and June 2023, respectively, when the interest rate was reduced from 200% to 150%.

To this end, a further downward review of the interest rate to 130% is anticipated to increase borrowing. However, the maintenance of the 75% interest gives no incentive to the productive sector to borrow despite more being available.

On the macroeconomic front, this continues to stabilize the inflation rate making the country a better investment destination, thereby improving competitiveness.

Despite this positive move, Zimbabwe’s interest rate of 130% per annum is extremely higher than regional comparator countries, that is, South Africa (11.75%), Botswana (8.95%), Mozambique (17.25%), Zambia (10%), Malawi (24%) and Namibia (8%).

To this end, a further reduction of interest rates to the prevailing levels within the region is recommended, as this allows businesses affordable rates to invest towards increased productivity and competitiveness.

Foreign Currency Retentions

It was resolved that with effect from 1 November 2023, foreign currency retentions on exports be standardized at 75% across all sectors of the economy and all special dispensations granted to some sectors of the economy shall be removed. The most affected group is the cotton and tobacco farmers who were at 85%, otherwise, 75% is retained for all other sectors.

This resolution was reached for the sole reason of increasing foreign exchange reserves available to the central bank and Government to meet foreign exchange requirements for the settlement of national and international obligations.

The Government’s ability to settle its debts improves the country’s creditworthiness to multilateral institutions and other international financiers. However, the misalignment between the parallel market and interbank exchange rates continues to impose exchange rate losses on exporters, hence depriving them of a competitive advantage.

It is worth noting that regionally, only Zimbabwean exporters retain less than 100% of their export proceeds. Regional peers such as South Africa are providing export incentives such as the Export Credit Insurance and other sector assistance schemes.

In this regard, Zimbabwean exporters cannot compete fairly on the international market as this retention is coming as a cost.

To this end, the Commission recommends 100% retention. To settle external payments, Government should strengthen the interbank foreign exchange market to unlock free funds and ease pressure on the foreign exchange auction. This will be complemented by corporate tax, international remittances, loan proceeds, income receipts and foreign investment.

Promotion of No-Frills (Low-Cost) Bank Accounts

This resolution augers well with the first resolution of the reduction of the bank policy rate while maintaining medium-term bank accommodation interest rates. Additionally, the recommendation that the Government consider removing the Intermediated Money Transfer Tax (IMTT) on transactions that are intermediated through plastic bank cards and other digital platforms is a very welcome move as this tax is posing a huge cost and a cumulative tax of more than the 2% along the value chains.

Businesses tend to pass on their costs and the final user (consumer) pays more than 2% as each stage will be passed on to the next. The removal of the 2% tax will therefore ease the cost burden on business, thereby reducing production costs as well as enhancing productivity and competitiveness.

Trading Margins

The removal of a limit of 10% trading margin above the interbank rate is a very welcome move towards harmonizing the exchange rate. Positive results are anticipated only when the central bank keeps the velocity of circulation low. Otherwise, a significant depreciation of the local currency (ZWL) is imminent.

Furthermore, depreciation has short-term gains on the competitiveness of the country as in the long run, the country will become uncompetitive. Mono-currency is noble; however, it does not have to be hurried.

To this end, the Government must come up with a de-dollarisation process/roadmap towards the use of our local currency, which has stakeholder buy-in.

The Commission recommends the gradual adoption of mono–currency in Zimbabwe.